21 August 2021

Patience Needed for US Economic Recovery to Trickle Down into Office Rental Improvement

This is largely due to rising improvement allowances and free rent that landlords have been extending to tenants.

A RISING tide lifts all boats, but not equally, apparently, when we look at how the US office sector has underperformed its sector counterparts in total returns, despite this year's strong recovery in the US economy (second quarter gross domestic product +6.5 per cent).

This is largely due to the headwinds of work-from-home (WFH) and tenants' wait-and-see approach in leasing new office space, which has had a knock-on effect on leasing transactions and rentals.

It has given rise to a tenants' market, where tenants have the upper hand to negotiate for better terms, which landlords feel obliged to accept in order to maintain or increase their property occupancies. This has resulted in overall sluggish office leasing and rental income improvement.

The Delta variant has thrown another spanner in the works - just when major companies had announced employees' return to the office following the US Labour Day holiday on Sept 6, and many are now delaying further to October and beyond. As a result, behind the scenes, boards and management in the United States are taking their time to renew office space or sign new leases.

But slow trickle-down effects and delayed office return plans aside, there is another factor about the US office sector that will require investors' patience before a further recovery in rental income pulls through.

This is the fact that landlords have been doling out more tenant concessions by way of tenant improvement (TI) allowances and free rent to prospective tenants through Covid-19 to woo them to sign longer leases.

Tenant Concessions

In the US, office tenants expect their landlords to fund TIs for office renovations and improvements. Typically, the longer the lease term, the greater the TI budget landlords are willing to offer. Tenants are therefore incentivised to sign longer leases to receive a larger TI budget and to refurbish or fit out their space to their desired modern standards.

While the limits of what TIs can be used for is unique to each lease and depends on the negotiated amount, as well as each tenant's needs, the scope of work may typically include fit-out such as remodelling of the interior, addition of internal staircases, private offices, auditoriums, polished concrete floors, kitchens, or even just giving the space a fresh coat of paint and new carpeting.

Free rent is a negotiated period where tenants do not pay rent. On average, longer-term tenants (who sign leases of five to 10 years - compared to an average two to three years in Singapore) are given a month of free rent for every year of lease that they sign. That means that a tenant may receive 10 months of free rent for a 10-year lease. This free rent period may be given at the start of a leasing period, or, with the tenant's agreement, can be spread through the years of the tenancy.

Currently, with higher free rent, landlords are often waiting longer for actual rental payments to begin after a tenancy has commenced.

In some ways, offering concessions presents a win-win situation. The tenants enjoy lower net effective rents from the concessions, while the landlords get greater assurance about the fate and stability of their portfolio down the road. In today's tenants' market, dangling carrots can help secure commitments for large floor plates that would otherwise be detrimental to a landlord's financial performance if left vacant.

However, while there are benefits to both tenants and landlords, the fact is that in today's market conditions, higher costs paid by landlords and better terms achieved by tenants are squeezing rental incomes. For a real estate investment trust (Reit), that ultimately means pressure on net operating income and can reduce distributions per unit.

The Numbers

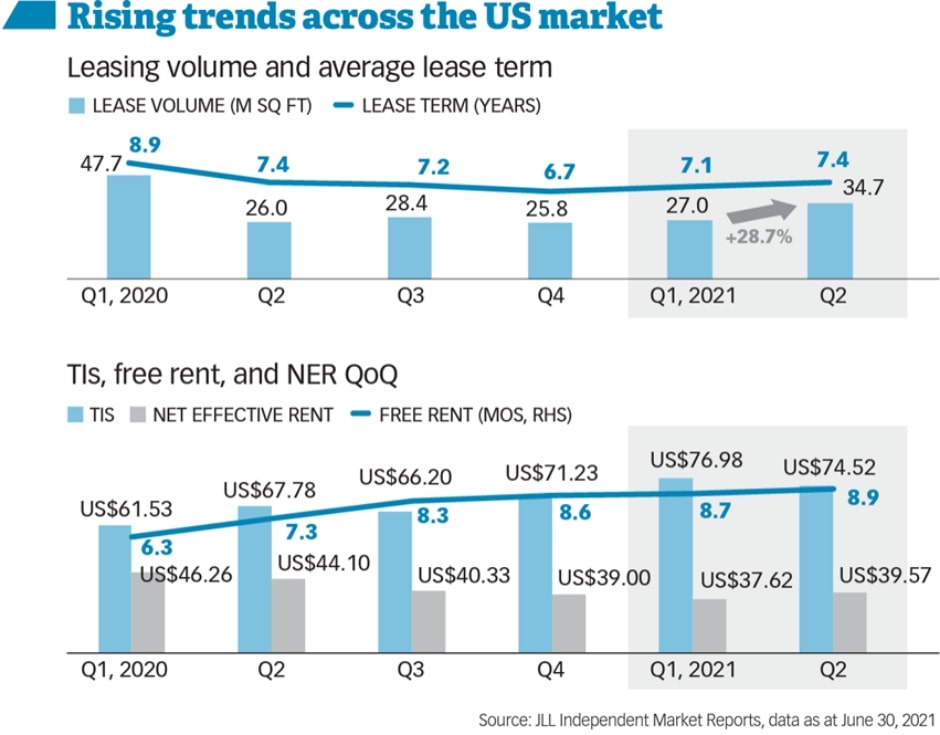

Let's look at the current leasing costs in more detail. Data compiled by JLL showed that leasing volume increased 29 per cent across the US office sector in Q2 of this year to the highest level the market has seen since Covid-19 began.

Tenants were also willing to sign longer term leases averaging 7.4 years in Q2, compared to 7.1 years in the previous quarter. These positive trends are evidence of tenants' increasing confidence about their post Covid-19 space needs.

That said, across the US market, concession packages (which include TIs and free rent) increased a whopping 32 per cent from Q1 2020 to Q1 2021. This moderated in Q2 2021, as TIs dipped 3 per cent to US$74.52 per square foot (psf), from US$76.98 psf in the previous quarter. This compared to TIs of just US$61.53 psf in Q1 2020.

The upward trajectory in free rents has continued unabated, rising from 6.3 months in Q1 2020 to 8.9 months in Q2 2021 - a more than 40 per cent increase. The rise in concessions was largely met with flattish rents, which resulted in a decline in net effective rents of 15 per cent for CBD Class A space in primary US markets.

As a result, for CBD Class A transactions in Q2 2021, TIs and free rent now account for about 29 per cent of the total value of a lease, above the 21 per cent and 24 per cent recorded in Q4 2019 and Q4 2018, respectively.

Inflection Point and Bright Spots

The US office market is approaching an inflection point. A pull-back in groundbreaking last year has also brought down overall construction activity, limiting oncoming office supply, which will further help the market stabilise.

The US macroeconomic recovery will also give the office sector a boost, as unemployment continues to decline and consumer sentiment and spending improve, fuelled by greater mobility and improved vaccination rates.

But until the US office market reaches an equilibrium, landlords may need to keep offering flexible leasing packages ranging from temporary shorter-term leases with lower leasing costs to attractive concessions for longer leases.

They will also have to be proactive in signing forward renewals for existing tenants in order to contain future risks. Across the market, leasing activity is picking up from the Covid-19 rut, and with time, improvement in rental income should follow.

There are additional bright spots for the US office sector - for instance, on the subleasing front, where more than 5.4 million square feet of sublease space has been taken off the market since March 2021.

This is as tenants realise the importance of their office space or seek to de-densify or meet reduced remote work expectations, and the trend is expected to continue in the remainder of 2021 going into 2022.

According to JLL, office landlords have also managed to preserve average CBD Class A asking rents at about US$66 psf, which have barely budged during the pandemic. Effective rents might take time to recover, but landlords can tighten their belts in the meantime by deferring non-essential capital expenditure.

All in all, while TI allowances may take a bite out of gross rental numbers, they can also help to modernise and improve a building, even if just within the four walls of tenants' space.

And while asset owners wait for the office leasing market to achieve its equilibrium, they can consider entering higher growth markets where there is still a dash for office space by companies in the burgeoning technology, healthcare and knowledge economy. This way, landlords can reduce the cash flow variability caused by elevated leasing costs.

This article was first published in The Business Times.