About MUST

About Manulife US REIT

Manulife US Real Estate Investment Trust (Manulife US REIT) is a Singapore REIT listed on the Singapore Exchange Securities Trading Limited (the SGX-ST) since 20 May 2016.

As at 31 December 2024, Manulife US REIT’s portfolio comprises of 9 office properties in the United States, with an aggregate net lettable area of 4.6 million sq ft. The 9 freehold office properties are strategically located in Arizona, California, Georgia, New Jersey, Virginia and Washington, D.C.

The Sponsor

The Manager of Manulife US REIT is wholly owned by the Sponsor, The Manufacturers Life Insurance Company (Manulife), part of the Manulife Group. The Sponsor's parent company, Manulife Financial Corporation (MFC), is a leading international financial services group providing forward-thinking solutions to help people with big financial decisions. It operates as John Hancock in the U.S., and Manulife elsewhere providing financial advice, insurance and wealth and asset management solutions for individuals, groups and institutions.

Mission

To provide Unitholders with sustainable distributions and risk-adjusted total returns

Vision

To create long-term value for stakeholders by building a resilient and diversified U.S. real estate portfolio

REIT Structure

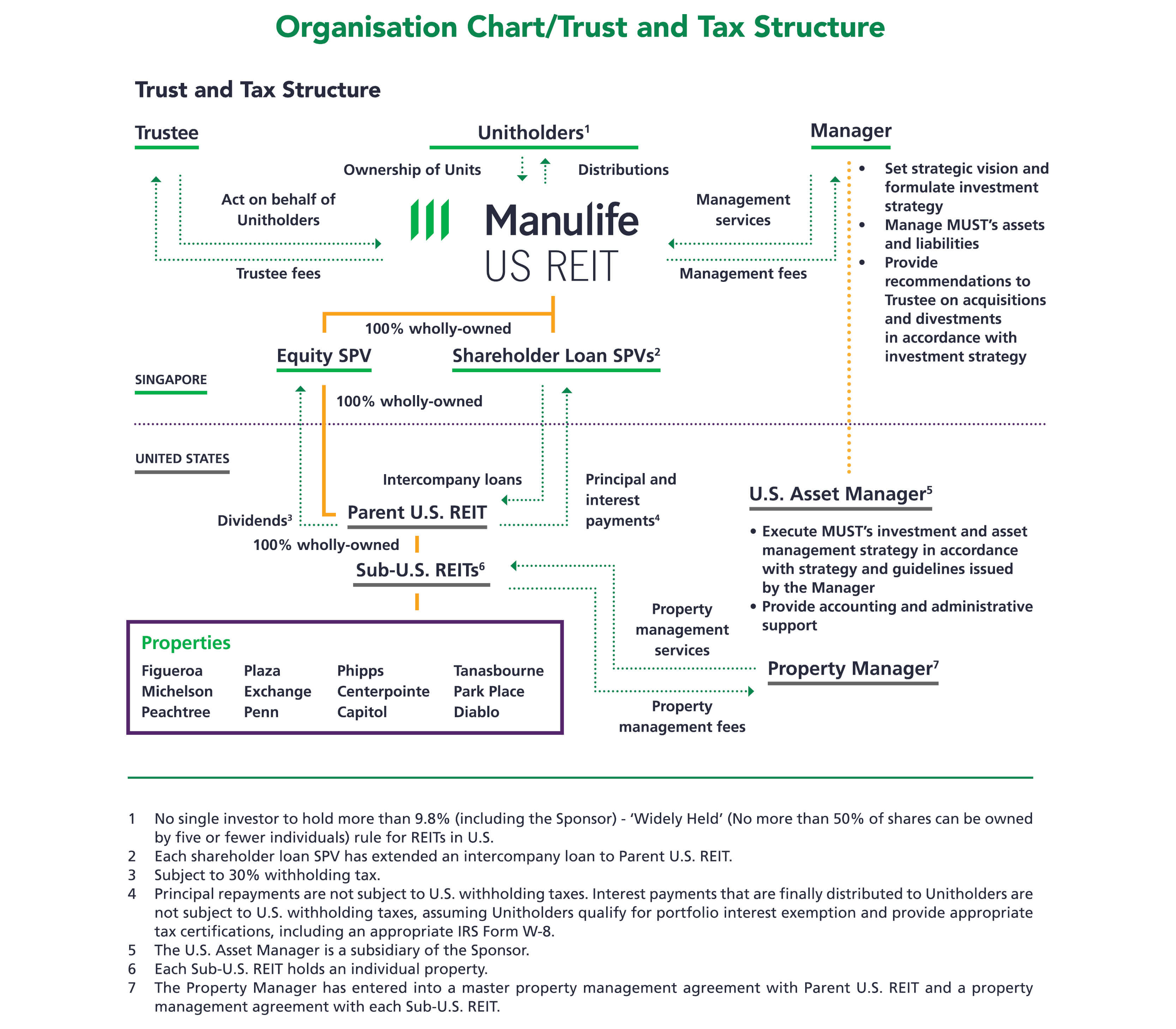

Manulife US REIT will be investing in the Properties in the United States through special purpose vehicles (SPVs) that are wholly-owned subsidiaries of the Parent U.S. REIT and organised so as to qualify as U.S. REITs.

U.S. REITs are generally permitted to deduct dividends paid to their shareholders from their U.S. federal (and in most instances, state) taxable income. It is intended that each Property will be acquired and held in a separate U.S. REIT.

This structure may facilitate financing on more attractive terms than might be available if the Properties were held by a single U.S. REIT.

Additionally, if Manulife US REIT desires to dispose of any one of the Properties, the exit can be structured as a sale of the shares of the U.S. REIT which owns the Property rather than a sale of the underlying real property, with the goal of simplifying legal transfer and eliminating any otherwise applicable U.S. branch profits tax on the transaction.

The following diagram illustrates the relationship, among others, between Manulife US REIT, the Manager, the Trustee, the U.S. Asset Manager and the Unitholders

Investment Strategy

Manulife US REIT is a Singapore listed REIT established with the investment strategy principally to invest, directly or indirectly, in a portfolio of income-producing office real estate in key markets in the United States, as well as real estate-related assets.

In accordance with the requirements of the Listing Manual, Manulife US Real Estate Management Pte. Ltd. (the Manager)'s investment strategy for Manulife US REIT will be adhered to for at least three years following the Listing Date.

The Manager's investment strategy for Manulife US REIT may only be changed within three years from the Listing Date if an Extraordinary Resolution is passed at a meeting of Unitholders duly convened and held in accordance with the provisions of the Trust Deed.

Growth Strategy

The Manager recognises the importance of driving value creation and is committed to deliver long-term value to its Unitholders and stakeholders. Its long-term success is driven by four key pillars.

- Organic Growth

- Inorganic Growth

- Capital Management

- Growing Responsibly

Policies and Procedures